FX Transactions

Overview

In energy commodities trading, FX (foreign exchange) transactions are essential for managing exposure to currency fluctuations — especially when physical commodities are priced in USD or other foreign currencies, but your reporting currency is different. Molecule supports three types of FX transactions: FX Forwards, FX Swaps, and Non-Delivering Forwards.These instruments allow you to hedge currency exposure, trade FX directly, and manage foreign exchange risk.

Prerequisites

FX transactions feature enabled on your account

Appropriate trading permissions

Understanding of FX market conventions

Access to FX rate data (spot and forward rates)

Supported FX Transaction Types

Type

Description

FX Forwards

Purpose: Lock in a future exchange rate

Settlement: Exchange both currencies at maturity

Use Case: Hedge known future currency exposure

FX Swaps

Purpose: Temporarily exchange currencies

Settlement: Exchange currencies at spot, reverse at maturity

Use Case: Manage short-term liquidity or hedge timing differences

Non-Delivering Forwards

Purpose: FX rate hedge without currency exchange

Settlement: Cash settlement in one currency only

Use Case: Hedge FX exposure without operational currency exchange

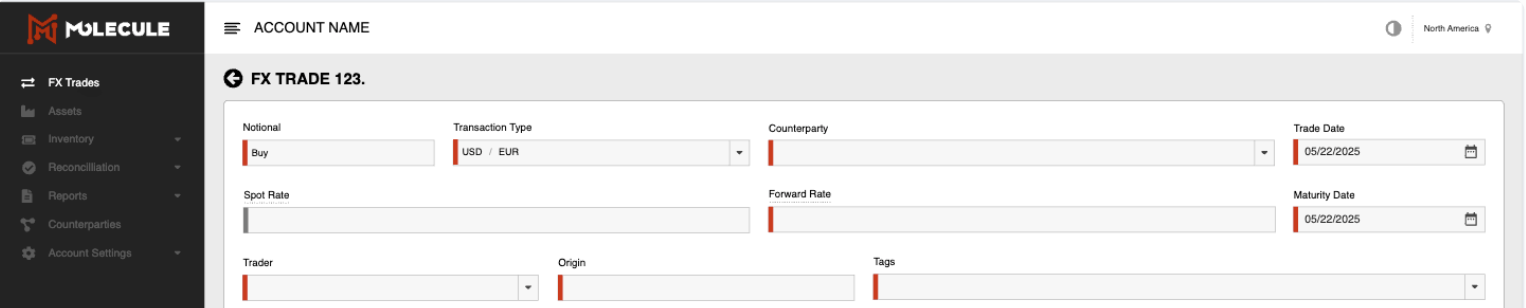

Entering FX Transactions

Access FX Trading

Navigate to Trading > FX Transactions

Click New FX Trade

Select Transaction type from the dropdown

FX Trade Entry Form:

Currency Pair Section

Base Currency: First currency in pair (what you're buying/selling)

Quote Currency: Second currency in pair (what you're paying with)

Flip Button: Quickly reverse the currency pair (EUR/USD ↔ USD/EUR)

Base/Quote Format: EUR/USD means EUR is base, USD is quote

Buy: Long the base currency, short the quote currency

Sell: Short the base currency, long the quote currency

Transaction Details

Transaction Type: Forward, Swap, or Non-Delivering Forward

Direction: Buy (long base currency) or Sell (short base currency)

Notional: Trade size in base currency units

Trade Date: When the transaction was executed

Rates Section

Forward Rate: Exchange rate for settlement (required for all types)

Spot Rate: Current exchange rate (required for swaps only)

Fixed Rates: Enter specific exchange rate, for example:

1.0850Formula Rates: Use rate formulas, for example,

ECB 2025-08-25..2025-08-29Rates determined from market data sources. Useful when final rate is set closer to maturity

Settlement Information

Maturity Date: When currencies are exchanged

Counterparty: Trading counterparty

Tags: For trade categorization and reporting

Managing FX Positions

FX Trades List

View: All FX transactions in dedicated trades list

Filtering: By currency pair, counterparty, maturity date

Sorting: By trade date, maturity, notional amount

Status: Track trade lifecycle and settlement status

Position Monitoring

Currency Exposures: View net positions by currency

Maturity Profile: See when positions mature

P&L Tracking: Mark-to-market valuation updates

Risk Metrics: Exposure amounts and concentration

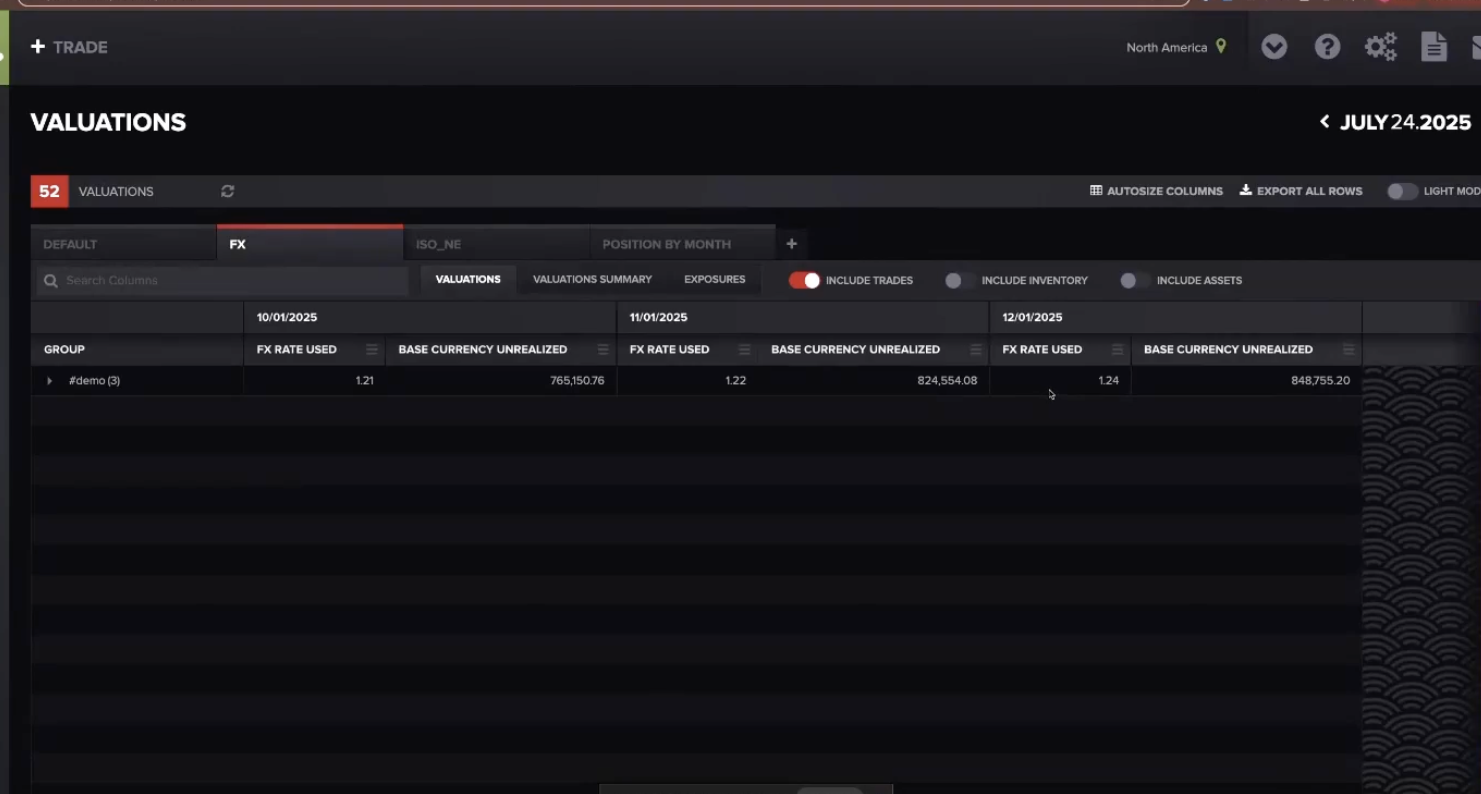

FX Valuation and P&L

Valuation Method & Rate Sources

FX transactions use forward rates (not commodity marks) for valuation: P&L = (Current Forward Rate - Trade Forward Rate) × Notional × FX Rate

Sources: Current Forward Rate: From your uploaded forward curves | Trade Forward Rate: Rate entered when trade was booked | FX Rate: Conversion rate to account base currency

Best Practices & Troubleshooting

Best Practices

When entering trades, it is essential to follow a consistent validation process to ensure accuracy and alignment with hedging strategies.

Begin by verifying forward rates against reliable market data sources to confirm pricing integrity.

Next, check that the buy or sell direction of each trade reflects the intended market position.

Carefully validate maturity dates to ensure they align with the hedging timeline of underlying exposures.

Additionally, document the purpose of each trade by applying appropriate tags to identify the associated hedging relationships, which supports auditability and reporting.

From a risk management perspective, maintain regular oversight of currency exposures to

Ensure positions remain within defined risk parameters.

Align the maturities of FX hedges with the tenors of the underlying exposures to avoid mismatches.

To mitigate credit risk, diversify counterparties by distributing trades across multiple banking institutions.

Finally, consistently track profit and loss by monitoring mark-to-market changes, helping to evaluate hedge effectiveness and financial impact over time.

Troubleshooting:

Problem

Solution

Can't see FX transaction entry

Verify FX transactions are enabled and you have trading permissions

Rates not updating properly

Check that forward curves are uploaded for your currency pairs

P&L calculations seem incorrect

Verify forward curve data and check base currency conversion

Last updated

Was this helpful?