Assets Stack

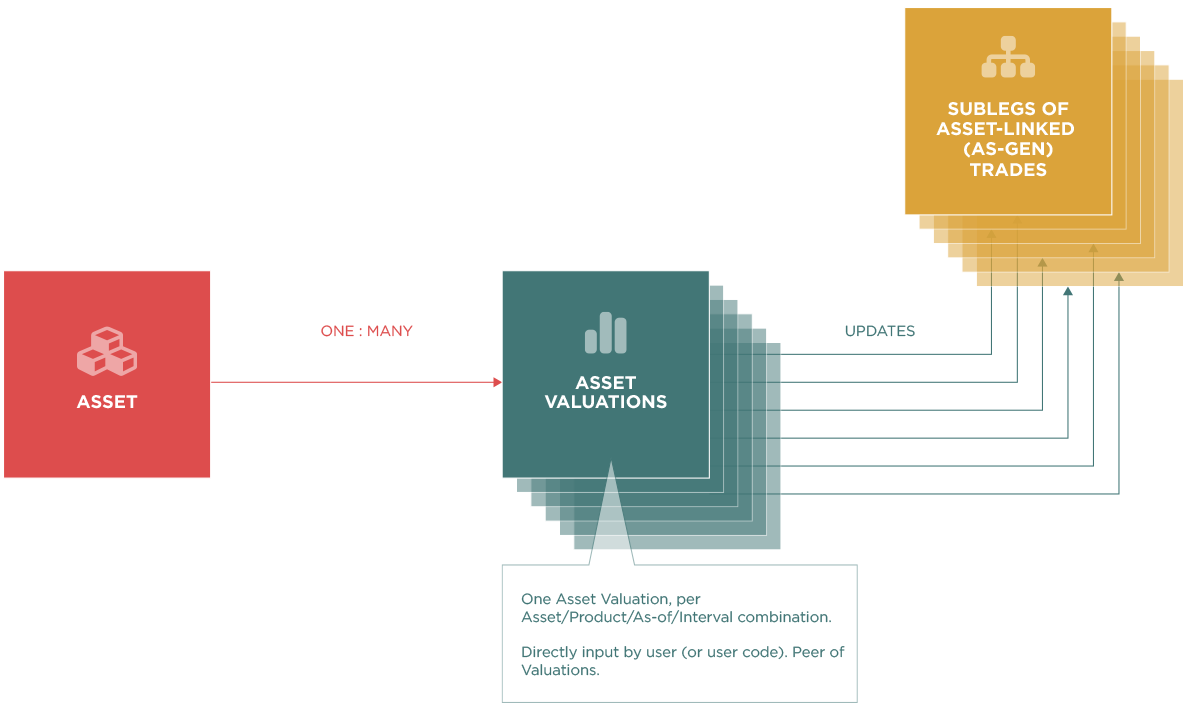

Broadly, Assets provide users the ability to directly write Asset Valuation rows that can line up with Trade Valuation rows. Assets are often used for custom shape, forecasts, natural positions, or even as repositories for the output of custom valuation models.

Stack

Asset Lifecycle

When an Asset is created, a row is created in the Asset model; nothing else. Users can decide whether child Asset Valuation rows will be created by one of two methods:

- Automated Valuation Update: The Asset can connect to a location (e.g., an external data source) that provides a daily curve of positions, valuations, or other relevant data.

- Manual Entry: Users can upload valuations directly or post data via API.

User Interaction

Users interact directly with Asset Valuations — that's what this model is for. It's the place in Molecule where users have the most direct control.

Downstream

When Asset Valuation rows are created, they generally do not trigger downstream actions. However, for Assets linked to Trades, updates to Asset Valuations automatically adjust the Trade Subleg volumes. This linkage is particularly useful for:

- Power Purchase Agreements (PPAs): Accurate volume tracking for long-term contracts.

- Position and Risk Modeling: Ensuring native positions are included in Value at Risk (VaR) calculations and other risk assessments.