Loading Option Prices and Volatilities

Option Valuation Inputs

For the inputs into Molecule's option valuations models, you can either choose to:

- Load option prices and underlying prices, then system calculates implied volatilities

- Load volatilities and underlying prices

In either case, Molecule is able to interpolate linearly between strike prices.

Loading Option Price Surfaces

You can load price surfaces for the option and Molecule will calculate the implied volatilities to be used in the valuation models.

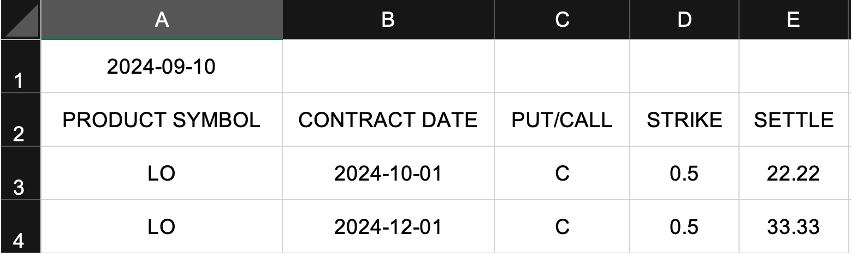

Via Spreadsheet

The format for loading option prices via spreadsheet is seen here.

Cell A1 is the as_of date

Each row below contains a single contract start, put or call, strike price and option price (settle column).

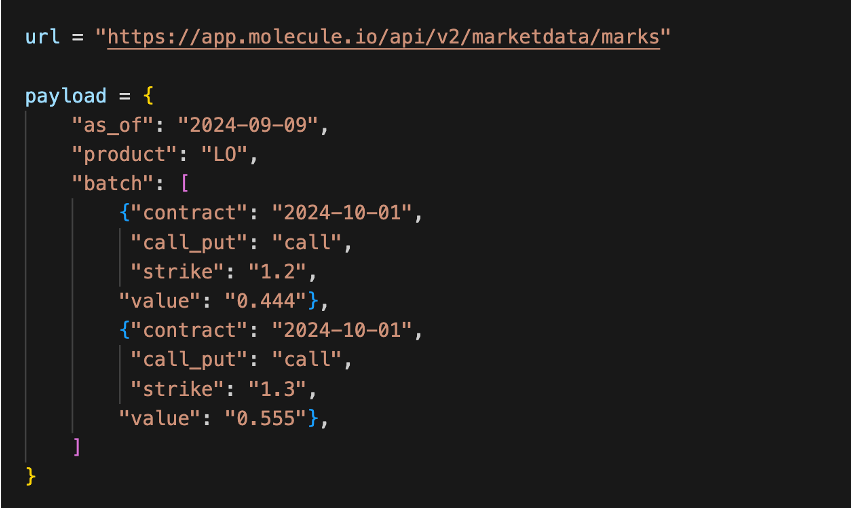

Via API

The API endpoint for loading option price surfaces is the same as other market data:

Batch loading is available and is more efficient than multiple API calls.

Sample payload:

See https://developer.molecule.io/reference/createmark-1 for further information.

Loading Option Volatilties

Loaded vols are in the form of percentages, to be ready for input into Black-Scholes.

Data must be based on absolute strike price, not distance in or out of the money.

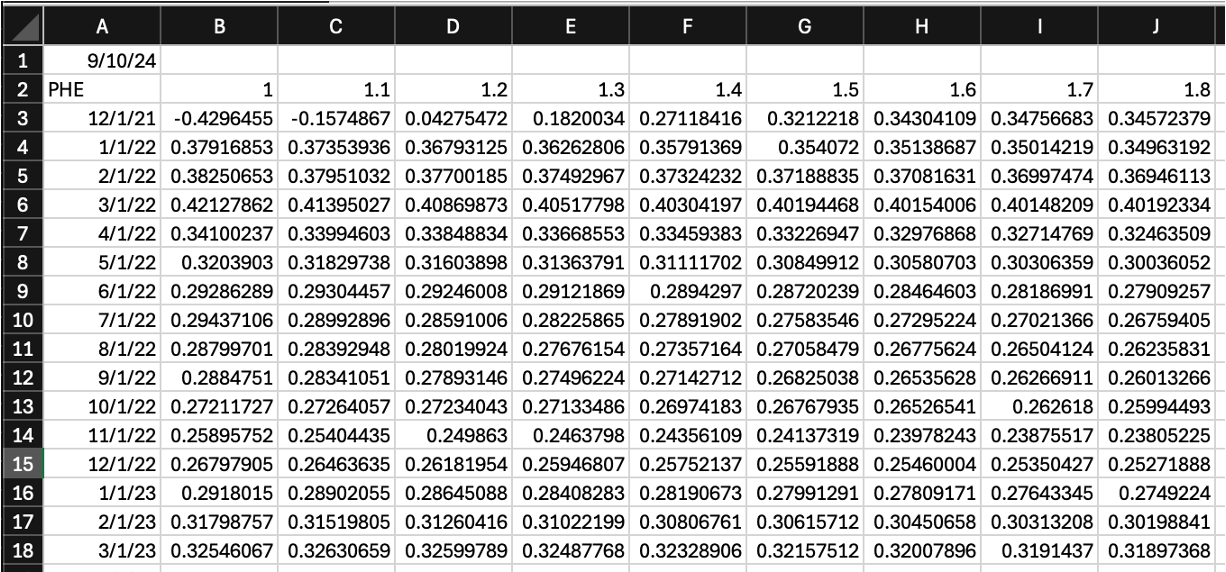

Via Spreadsheet

The format for loading option prices via spreadsheet is seen here.

Cell A1 is the as_of date, and cell A2 is the Molecule product code.

The strikes are across the top, the contract start dates are down column A, and the volatilities are in the body of the table.

Via API

See https://developer.molecule.io/reference/createvol-1 for more info