Valuation & Relevant Products

Molecule's valuation engine performs 100+ calculations for each trade, every day. Trades have dozens of possible permutations as to how the engine treats them; everything from balmo calculations, to option valuation, to block conversions. Molecule hides much of this complexity behind a simple concept: Relevant Products.

Relevant for a Trade

Simple Valuation

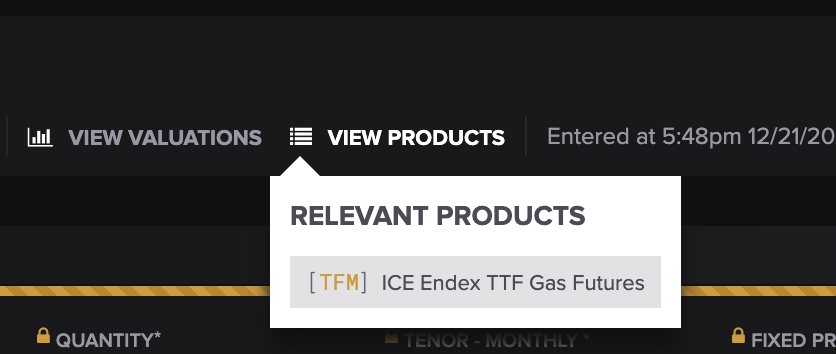

The Relevant Products for a trade are the ones for whom market data arrival should trigger valuation. In other words, if a trade has this relevant Product, uploading market data with this ticker will trigger this trade's valuation (on its trade date, its expiry, and every day in between):

Option Valuation

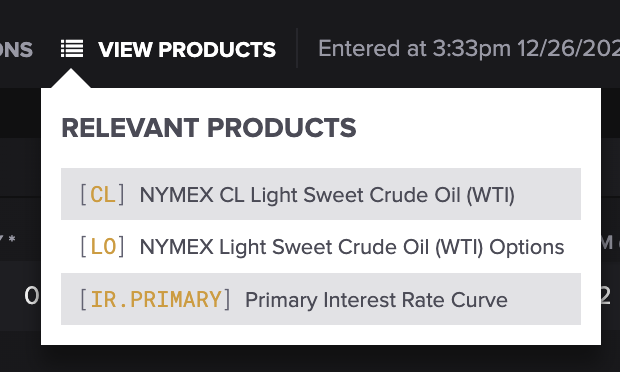

Options add a (very light) layer of complexity.

Given a NYMEX crude option, the arrival of market data with any of these tickers will trigger this trade's valuation (note that LO prices and volatilities are accepted, and the system decides whether to imply a volatility or option price). On expiry, just the CL will be used. The Product LO is configured to use it to determine exercise status.

More Complex Valuations

In other scenarios, a trade will expect other sets of Relevant Products.

For an FTR:

- Trade Product: for forward marking

- Source Product: for settlement

- Sink Product: for settlement

For a formula-priced bilateral trade:

- Trade Product

- Any Products in the trade's formula price (used for Exposures)

- The Product used to mark the trade (and any products used in building the curve for this mark; also for Exposures)

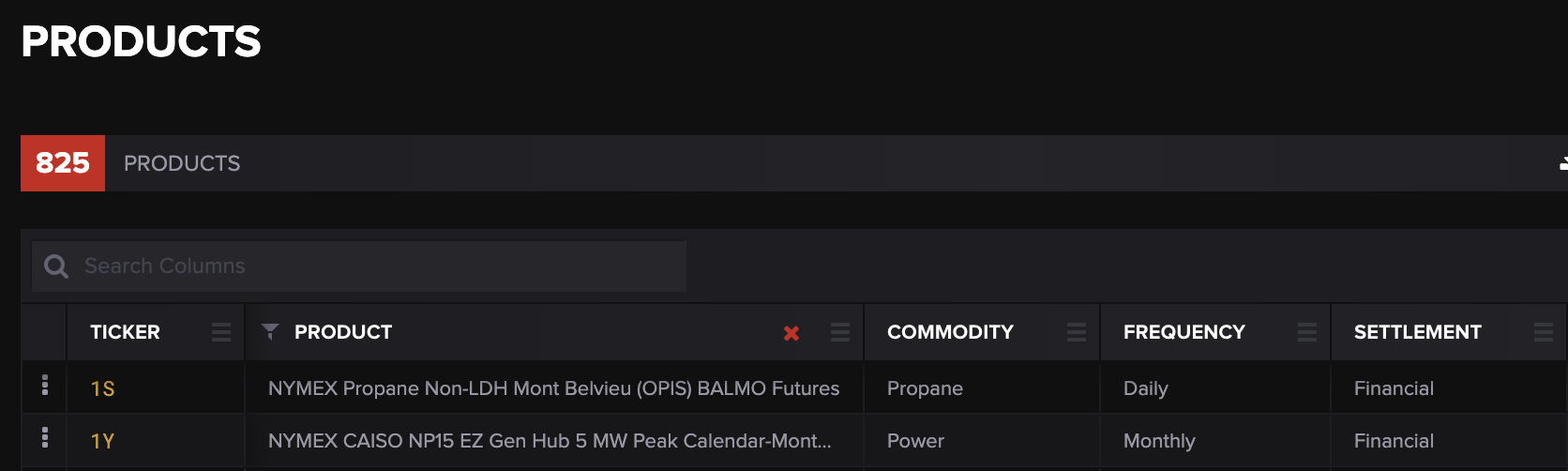

Relevant for the Account

The combination of all Products, on all Trades (and Assets, and Market Data) used for your Account is shown on the Products screen, at Settings/Products. This list is built dynamically.